It may also explain why the short interest stands at around a third of shares according to Seeking Alpha. Indeed, in early May, an "at the market" equity offering was announced for up to $200.00 million in common stock, which means the executive team can now raise equity financing fairly quickly.įalling revenues, large losses, and the state of the balance sheet help explain why the ticker is trading at all-time lows. To address the debt load, management may be forced to issue shares and dilute existing owners. This means the name has a substantial net debt position and has negative equity.įinding a way to pay off this debt (and interest) will be a challenge. By contrast, cash was $258.60 million and total assets stood at $986.60 million. In the latest quarter, the total debt stood at $1,183.00 million, of which $1,134.60 million was long-term debt. In the case of BYND, the firm has added a huge amount of leverage. Organizations that consistently lose large amounts of money often dilute shareholders, borrow, or do both. In 2022, the annual loss was a whopping $366.14 million, and even the latest quarter saw a loss of $59.04 million.

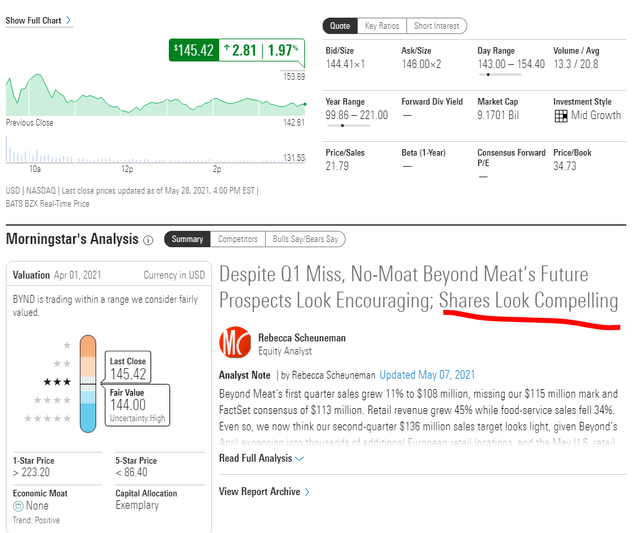

The company has regularly lost money since it was listed and there is no evidence that it has pricing power with consumers. Instead of growing, the top line is contracting, and volumes are down. The scale of these problems is hard to understate. Instead of envisioning the ways it will change the world, analysts are now focused on the corporation's operational and financial challenges. Beyond Meat is in a difficult position, and the stock is speculative. Current Financials, Investor Sentiment, And Valuations: Instead, BYND has proven to be growth at an unreasonable price, and shareholders have been burned. Instead of considering the lofty valuations and lack of profitability, investors hyped themselves into a frenzy on the hope it would grow wildly. This meant that other valuation metrics like price-to-earnings, price-to-cashflows, and EV/EBITDA were not useful. Moreover, the price-to-book ratio did not look much better, and there was no net income, EBITDA, or cash flow. TIKR - BYND P/S chart June 2019 to May 2023 (TIKR)Įven for much of 20, investors were paying between 15- and 20-times sales. As the chart below demonstrates, investors in mid-2019 were typically paying over 50 times sales, and were briefly paying more than 100 times sales. This is because even the most promising company with the best industry prospects can be too expensive. The reason for this drop is simple: investors overpaid. Since mid-2019, the stock has cratered, and is now below the IPO price of $25.00. Investors were thrilled at the thought of owning a piece of this future and did not care about valuations, net losses, competition, capex requirements, or lofty growth expectations. At the time, analysts thought plant-based meat products like burgers, sausages, and other items designed to look and taste like meat were going to revolutionize the way people eat, disrupt the food industry, and cut the environmental impacts associated with meat-heavy diets. It was initially listed at $25.00, but started trading at $46.00 and hit highs over $230.00 in mid-2019.

In 2019, the venture IPOed to much fanfare. Why Has BYND Stock Dropped And How Did Owners Get Here? Though the business has historically been a leader in its field, the stock has been hammered and is trading near all-time lows. The organization sells its products in countries around the world and has well-established relationships with restaurants and grocers. ( NASDAQ: BYND) is a plant-based meat company that manufactures and markets meat-free alternatives to beef, pork, and poultry.

0 kommentar(er)

0 kommentar(er)